Think long term and reap the rewards

Investing isn’t about becoming as wealthy as possible in the shortest amount of time. It’s not a ‘get rich quick’ scheme, so be wary of anyone claiming otherwise. It should, however, improve your quality of life when approached wisely.

Very few people just wake up one day and become wealthy. It takes planning, patience and consistency. Educate yourself by reading the best investing books to learn from the greats, listen to investing podcasts to keep up with current trends, market news and company updates. Sign up to newsletters from blogs you enjoy reading and take note of great products and services that you come across.

Create a plan and stick to it

When investing, it helps to have a plan to follow through the ups and the downs. If you put together a considered investment strategy when you’re calm and rational, it’ll be there to guide you when you’re not.

Your plan could be as simple as investing a certain amount per month into 10 core stocks or ETFs. Or you can construct a more comprehensive approach to address a range of scenarios, leaving you prepared for whatever might happen. Deciding how involved you want to be in selecting and monitoring assets in your portfolio is an important part of the process.

“To be a successful investor, you have to have a philosophy and process you believe in and can stick to, even under pressure”

Howard Marks

Confidence in a well considered plan will benefit you in the long term. It will be the difference between holding on to your quality, carefully chosen investments during a downturn or selling out of fear and missing out on future gains. It’ll allow you to filter out the noise and clearly identify opportunities that you’ll thank yourself later for calmly picking when others were running for the hills.

Scan the horizon

The Motley Fool’s David Gardner says it best in the following quote:

“Make your portfolio reflect your best vision for our future.”

David Gardner

If you invest your time and your money in a way that reflects the world you want to see, you will be able to spot future trends and can keep track of the story as it unfolds. This is key to thinking long term.

Invest in years, not months or days

The consensus is that to take full advantage of the long-term gains of the market, you should hold stocks for a minimum of 3-5 years. This ensures that you can ride out the dips and benefit from the upward trajectory of the market as a whole.

A common phrase in investing circles is “it’s about time in the markets, not timing the markets”. In other words, the best way to make money is to stay invested for many years, rather than worrying about whether now is the best time to invest.

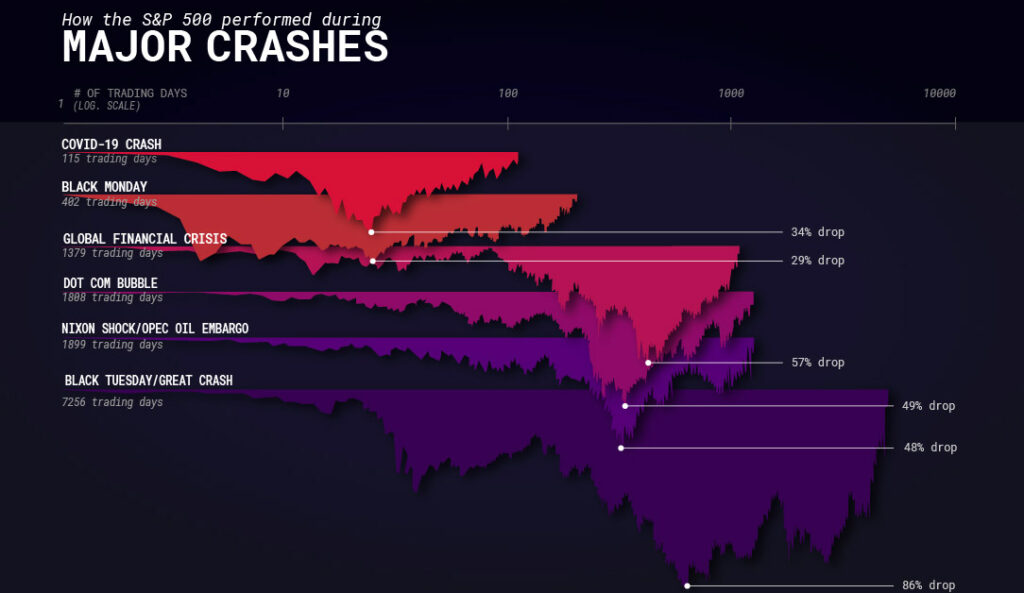

In the short term, anything can happen: market crashes, black swan events and market corrections. Decades from the seemingly disastrous event, the drop is diluted to a small blip on the otherwise positive gains – just look at the S&P 500 (the top 500 largest publicly listed companies in the United States) over the last 40 years:

Here’s a great visual that shows how the S&P 500 bounced back after each of the major crashes (original article here):

Nobody can predict the future and so nobody can consistently time their investments to best suit what the stock market is going to do next. Moving cash in and out of investments too often is a sure-fire way of racking up fees, missing gains and losing money.

This is why thinking long term and staying invested will benefit you more in years to come.